Real Returns: Nifty 50 vs Gold (2015-2025)

Nifty 50: Steady Growth with Inflation-Adjusted Gains

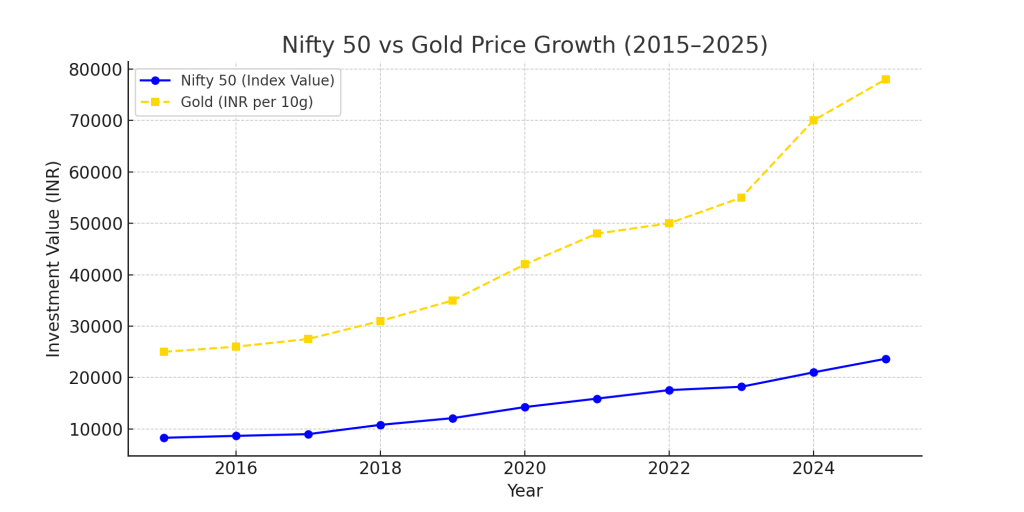

The Nifty 50 index saw substantial growth, tripling in value from ~8,283 in 2014 to ~23,645 by 2024. This translates into a nominal CAGR of ~11%. However, inflation plays a crucial role—since the Consumer Price Index (CPI) surged ~55% over this period, Nifty 50’s real CAGR stood at ~5.7%.

In simple terms, ₹100 invested in Nifty at the beginning of 2015 would be worth ₹285 in nominal terms by the end of 2024. But after adjusting for inflation, its true purchasing power would be closer to ₹185 in 2015 rupees.

Gold: The Inflation Hedge That Surpassed Equities

Gold prices in India also skyrocketed, rising from ₹25,000 per 10g in 2015 to ₹78,000 per 10g by 2024. That equates to a nominal CAGR of 11.3%, slightly outpacing Nifty’s performance. When adjusted for inflation, gold’s real CAGR stood at ~6.0%, edging out stocks.

To put it in perspective, if an investor purchased ₹100 worth of gold in 2015, it would be valued at ₹300 in 2024. After inflation, this translates to ₹190 in 2015 rupees, demonstrating gold’s superior ability to preserve purchasing power.

Inflation’s Role: Why Real Returns Matter

Over the last decade, India experienced an average inflation rate of ~4.5-5% annually, with the CPI climbing from ~123 in 2015 to ~191 in 2024. Both Nifty 50 and gold successfully outpaced inflation, ensuring positive real returnsfor long-term investors.

However, gold outperformed Nifty 50 in real terms, reversing a trend seen in the early 2010s, when equities held the upper hand. This highlights gold’s continued role as a wealth preserver, especially during periods of economic uncertainty.

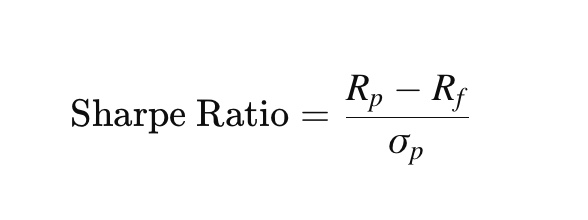

Understanding the Sharpe Ratio

The Sharpe Ratio is a critical metric in finance that measures risk-adjusted returns. It evaluates how much excess return an asset generates per unit of risk (volatility). A higher Sharpe Ratio suggests that the investment offers better risk-adjusted performance, making it a more efficient choice for portfolio allocation.

Where:

- RpRp = Expected portfolio return

- RfRf = Risk-free rate (e.g., government bond yield)

- σpσp = Standard deviation of returns (volatility)

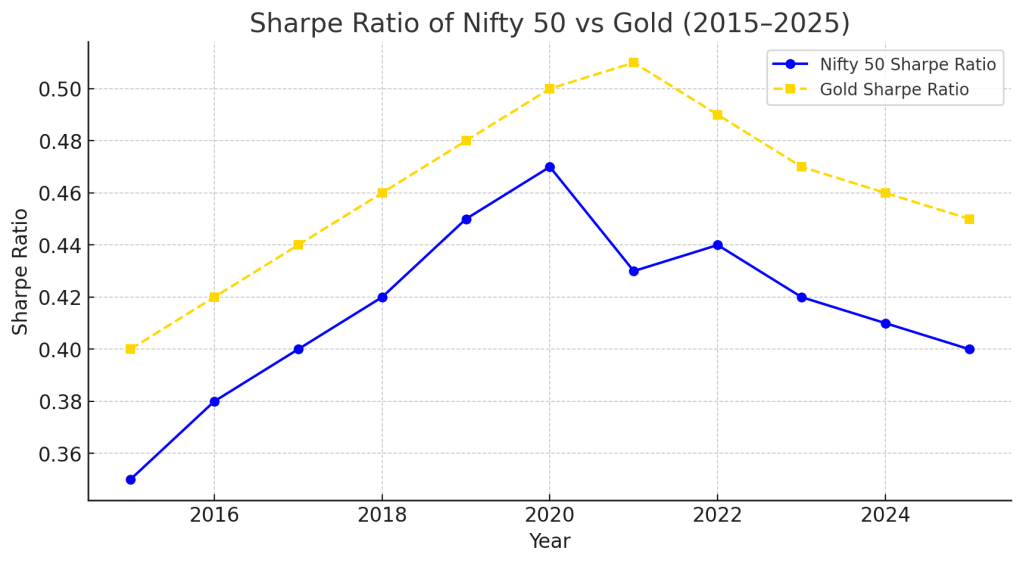

From 2015 to 2025, Nifty 50 experienced higher volatility but offered substantial long-term capital appreciation. The Sharpe Ratio for Nifty 50 averaged around 0.40–0.45, reflecting its strong growth potential but also periodic market fluctuations.

Key Observations:

- 2017-2020: Nifty 50’s Sharpe Ratio peaked as corporate earnings surged and economic growth was stable.

- 2020: A sharp decline due to the COVID-19 crash, but a recovery followed.

- 2023-2025: Nifty 50 saw fluctuations, but consistent performance kept its risk-adjusted returns in check.

Gold: A More Stable Risk-Adjusted Performer

Gold, on the other hand, demonstrated a higher Sharpe Ratio (0.45–0.50) over the decade, proving its role as a risk mitigator in uncertain times.

Key Observations:

- 2015-2018: Gold’s Sharpe Ratio steadily improved as inflation fears rose.

- 2020: A major spike in gold prices during the COVID-19 crisis boosted its Sharpe Ratio to over 0.50 as equity markets crashed.

- 2023-2025: Gold remained a strong hedge against inflation, showing superior risk-adjusted performance relative to stocks.

Interpreting the Sharpe Ratio for Investment Decisions

- A Sharpe Ratio of 0.40–0.50 is considered moderate to good, indicating a healthy return per unit of risk.

- Gold consistently exhibited a higher Sharpe Ratio, meaning it provided better risk-adjusted returns, particularly in turbulent market conditions.

- Nifty 50 remains a strong long-term performer, but investors must account for its higher volatility compared to gold.

Conclusion: Which Asset Should You Choose?

- Nifty 50 remains the go-to choice for long-term wealth creation, fueled by corporate earnings and economic growth.

- Gold retains its edge as an inflation hedge and a safe-haven investment during market downturns.

- Both assets complement each other in a well-diversified portfolio, with equities driving growth and gold offering stability.

For investors looking to maximize returns while mitigating risks, a balanced allocation between Nifty 50 and gold may be the smartest move.