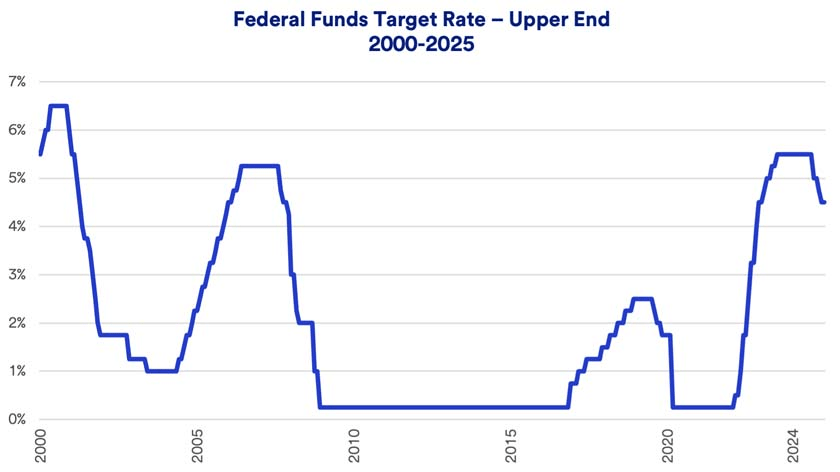

Central Banks Push Rates to Multi-Year Highs

- Fed communications will be critical. Chairman Powell has balanced signals by noting the Fed sees things “in a good place” and is not hurried to adjust policy, yet also acknowledging that further moves depend on incoming data. A “higher-for-longer” stance (holding rates high) would likely keep the dollar bid, whereas hints of an earlier easing could sink the dollar. Global liquidity dynamics also play a role: the U.S. Treasury’s cash management and quantitative tightening (QT) can tighten dollar liquidity. In early 2025, for example, the debt ceiling impasse led Treasury to , temporarily to markets and contributing to a dip in yields. Once the debt ceiling is resolved, heavy Treasury issuance could withdraw liquidity and potentially put upward pressure on yields and the dollar. On the other side, easier monetary policies abroad (e.g. rate cuts by ECB or stimulus in China) will inject global liquidity that may flow into non-dollar assets, eventually diluting some dollar demand. By mid-2025, if multiple countries are easing and risk appetite improves, investors might rotate into higher-yielding emerging markets and away from the safe-haven dollar – a scenario that could weaken DXY.

- Trade Policy and Geopolitics: The dollar’s safe-haven status means that uncertainty or risk aversion tends to boost it. Any flare-up in geopolitical tensions or financial market stress could spur flight-to-quality buying of dollars. Conversely, resolution of major risks might reduce that premium. A notable factor in 2025 is U.S. trade policy: the incoming administration’s plans for tariffs and protectionist measures are inflationary and dollar-positive in the near term. Markets recall that during the 2018 trade war, the dollar strengthened as tariffs disrupted global trade. If broad tariffs (e.g. a universal 10% import tariff reportedly considered) are implemented, they could delay Fed rate cuts (due to higher inflation), reinforcing dollar strength. At the same time, such policies could hurt growth in export-dependent economies (Europe, Asia), possibly forcing them to ease more and further widening rate differentials. Thus, aggressive U.S. trade policy could amplify dollar strength in the next few months. That said, if geopolitical tensions (e.g. in the Middle East) de-escalate or if trade disputes settle, the dollar’s safe-haven premium might fade, allowing some depreciation. In summary, the macro backdrop for DXY over the next six months leans bullish on the basis of U.S. economic resilience and interest rate advantages – but this comes with the caveat that any sign of the Fed blinking (or U.S. data turning south) could swiftly flip the narrative and send the dollar lower :

Technical Outlook and Key Levels

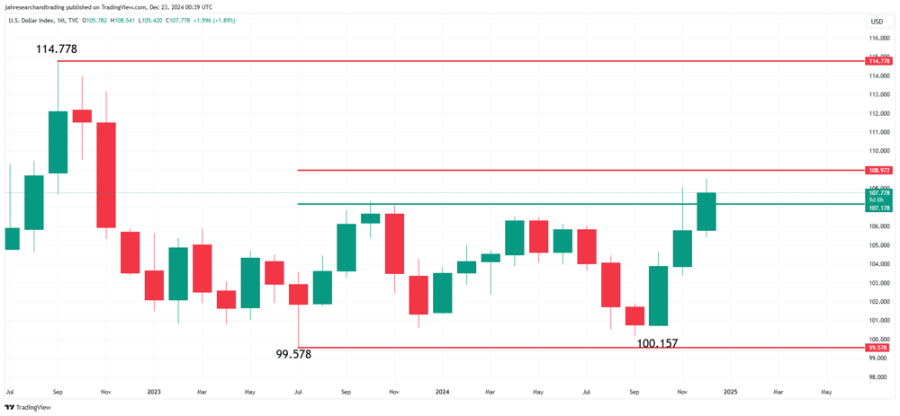

Figure 3: Monthly chart of the U.S. Dollar Index (DXY) with key support and resistance levels (July 2022–Dec 2024). After peaking at 114.78 in 2022, DXY fell to ~100 in mid-2023, then rebounded to the 107–108 zone by late 2024. Major resistance lies around 108–110, while the 99–100 area has acted as strong support in recent years :

From a technical analysis perspective, the dollar index’s recent price action suggests a mixed outlook. The late-2024 rally saw DXY jump about 7% from its September low (≈100.2) to over 107 by November.

This uptrend brought the index near a key resistance around the 108–109 level – an area that capped dollar rallies in 2020 and was tested again in late 2024.

.Indeed, chartists note that as long as DXY stays below the November peak (~108.07), the dollar may trade in a range rather than break to new highs.

The 105 level (mid-point of that range) is an interim support that had held through much of 2023–2024 trading. On the downside, the 100 level(approximately the lows of 2022’s second half and 2023) stands out as a critical support floor – a breach below 100 would signal a major bearish shift. Many analysts therefore anticipate range-bound movement 105±5 in the near term absent a big catalyst.

Momentum indicators and positioning data provide additional clues. The dollar’s rapid climb in Q4 2024 coincided with increasingly one-sided bullish positioning – the CFTC’s Commitment of Traders report showed net long USD positions against other currencies at the highest since mid-2023.

such crowded longs can be a contrarian warning. In early 2025, we saw evidence of this dynamic: DXY plunged ~3.5% in the first week of March.

Its worst weekly drop since 2022, as some of those long-dollar bets unwound when U.S. data disappointed. The index broke below its 50-day moving average during that pullback, suggesting a loss of short-term bullish momentum. Technical analysts now caution that the dollar could be due for further consolidation or a modest correction after its late-2024 surge.

If DXY were to rally again, it would need to clear the 108–109 resistance decisively – which could open the door to retesting the 2022 highs around 114. On the flip side, a drop below 102 would indicate the recent uptrend has reversed and put the focus back on the 100 level. In summary, technical signals point to a likely trading range for DXY in the next few months (roughly 100 on the low end, up to 108 on the high end), unless a breakout is triggered by unexpected fundamental developments.

Expert Forecasts and Market Sentiment

Market experts and forecasters are somewhat divided but generally see the dollar staying on a strong footing in the immediate future, with a potential inflection later in the year. Strategists at J.P. Morgan Asset Management note that the dollar “has continued to defy gravity,” climbing ~7% in 2024 despite Fed rate cuts, and they expect dollar strength to stabilize or persist into 2025given U.S. growth and yield advantages.

Their view is that the dollar’s valuation is stretched but that any downturn will likely require a clear catalyst – for now, U.S. outperformance and policy divergence justify a firm dollar.

Similarly, FX strategists at IG and FXEmpire highlight that President-elect Trump’s pro-growth, tariff-oriented agenda and the Fed’s cautious stance are underpinning the dollar’s rise. They argue that the combination of resilient U.S. data (strong services and retail sales) and a Fed that is less dovish than markets expected should support further dollar strength into early 2025.

In their analyses, even if the Fed delivers a 25 bp cut in December 2024, a more “data-dependent” approach in 2025 means the dollar keeps a yield edge.

Moreover, interest rate differentials could widen if Europe cuts rates faster (some experts foresee a 50 bp ECB cut in Jan 2025), which “may continue to fuel demand for the US dollar” going forward.

In practical forecasts, some investment banks had projected DXY to remain around the 105–110 range through Q2 2025, given the aforementioned factors (for instance, one major bank’s late-2024 outlook had end-Q1 DXY near 109 in a bullish case).

On the other hand, there is a growing consensus that later in 2025 the dollar could face headwinds. Currency strategists point to the dollar’s historical cycles – after a prolonged rally, the greenback could be nearing a peak, especially as its real effective value is extremely high by long-term standards.

Downside risks include: a faster-than-anticipated U.S. economic slowdown, which would push the Fed to cut rates more quickly (eroding the dollar’s carry); and a global recovery in risk appetite that sends investors into undervalued foreign assets and emerging markets. Some of these elements appeared in early March 2025: the euro had its best week in 16 years, jumping ~4.5% vs the dollar, after signs of European fiscal stimulus and soft U.S. labor data fed expectations of Fed easing.

This episode suggests the dollar’s rally could reverse sharply on any hint of the Fed pivoting more dovishly or if U.S. data disappoint. Indeed, one Reuters analysis remarked that the dollar’s drop to four-month lows in March came as traders started pricing in multiple 2025 rate cuts.

Looking at consensus forecasts, many economists expect the DXY to weaken modestly by late 2025 as U.S. rates eventually come down. However, in the six-month horizon (through Q3 2025), the prevailing expectation is for a range-bound or slightly strong dollar. RBC Capital Markets, for example, noted in Feb 2025 that while long-dollar positions had lightened somewhat, the USD is “still well-supported by its yield” in the first half of the year, and they saw the greenback maintaining gains from carry trades in the near term (barring a major risk-off shift).

In conclusion, the U.S. dollar index is forecast to remain relatively elevated over the next six months, buoyed by the Fed’s higher rates, U.S. economic resilience, and safe-haven flows. A plausible base case is DXY fluctuating in the low 100s to around 108 strengthening on any signs of U.S. outperformance or global turmoil, and softening on signals of Fed easing or abating risks. Investors and policymakers will be watching Fed communications, inflation prints, and global growth signals closely. Any clear inflection in those factors could tilt the dollar’s course. For now, the data-backed evidence suggests a cautiously strong dollar in the near term, even as the first cracks in its armor have started to appear with hints of future Fed rate relief. The balance of risks is shifting: “higher-for-longer” may keep the dollar king a bit longer, but a turn toward dollar weakness could emerge if U.S. inflation and rates decisively roll over, boosting emerging markets like India that have weathered the storm so far.